Sometimes a statement can be technically correct, but fundamentally and substantively false. Here’s a recent example.

President Biden was recently fact-checked by the Washington Post for claiming that the one thousand billionaires in the United States pay an average federal tax rate of 8.5% - much lower than the tax rate most Americans pay. The article goes on to state that the top 400 wealthiest taxpayers paid an effective tax rate of 23.1% in 2014 (apparently, that’s the latest year the information is available because President Trump prohibited publishing the information after that date). Not only that, those 400 people paid a total of $29.4 billion in income taxes – 2% of all income taxes – on income of $127 billion. That comes out to an effective tax rate of 23%. One commentator actually lamented that Biden’s comments risk “…even more opprobrium being heaped on wealthy taxpayers who are, based on widely cited statistics, paying a very large proportion of the aggregate income taxes the IRS collects each year.”[i] Golly, we can’t have that!

It is technically true that the wealthiest income earners pay the majority of federal income taxes. In 2020, the top 1% earned 22% of all income, and paid 42% of taxes.[ii] But the wealthy pay much more in income taxes than all other taxpayers because they have developed many mechanisms to reduce the amount of income they declare, and therefore how much they pay in taxes. That doesn’t mean they aren’t getting richer, it just means the wealth is accumulating in ways that aren’t subject to federal income taxes.

In 2021 Propublica published an article that disclosed secret information about income and taxes paid by four of the richest people in the country (Warren Buffet, Jeff Bezos, Michael Bloomberg and Elon Musk). During that time, together they paid total taxes of $1.7 billion on declared income of $16 billion. That’s a lot of income and a lot of taxes paid, and it comes out to an effective tax rate of 11%, somewhat lower than what an average taxpayer would pay.

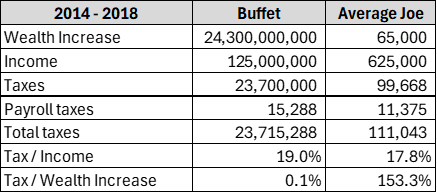

But during that same period, the collective wealth of those four billionaires grew by $159 billion, an average of $40 billion apiece. By comparison, according to Propublica during that same period average wage earners in their early 40s saw their net worth increase by $65,000 – largely due to the increase in their home values. Neither the billionaires nor the average Joes were taxed on their unrealized gains, but that was worth far, far more to the billionaires than to the non-billionaires. In fact, while the ratio of taxes paid to wealth increase was just 0.1% for Warren Buffet, it was over 150% for the Average Joe.

The following chart compares the situation of Warren Buffet – someone who has often argued that taxes should be increased on the wealthy – with an “Average Joe,” a married couple filing jointly that makes $125,000 per year. Calculations are based on U.S. federal income tax tables for 2018.

Based on this comparison, Warren Buffet actually paid a higher tax rate than our Average Joe – even taking into account the effects of payroll taxes, which add about 9.1% to Average Joe’s tax rate. But the payroll tax in 2018 only applied to incomes of up to $160,200, a negligible amount for Mr. Buffet, but a significant chunk of what the Average Joe paid. Still, if you stop the analysis here, the Washington Post is correct: billionaires like Warren Buffet pay effective tax rate on their declared income well above the 8% President Biden quoted.

Billionaires have a slew of tax experts who help them minimize what they pay in taxes, and that is their right. No one is obligated to pay more than they owe. The problem is what the tax laws permit them to do. Billionaires have figured out how to minimize the amounts they declare as ordinary income (which is taxed at a higher rate than capital gains), how to avoid realizing capital gains, and how to avoid paying estate taxes with sophisticated wealth planning techniques. They have a number of tax loopholes at their disposal which in many cases allow them to report losses even while making money. See this Propublica articles for more information about these techniques.

The bottom line is this: Billionaires and the top 1% of earners it the U.S. pay a large percentage of all taxes paid in the U.S., but between their declared earnings and the growth in their wealth, it is a fraction of what the average person pays in percentage terms. Joe Biden may be wrong about the exact percentage amount, but he is dead right about the fact that the rich are getting richer – much of it tax free.

[i] Robert Willens, a leading tax and accounting expert, as quoted in the Washington Post (https://www.washingtonpost.com/politics/2024/01/23/biden-keeps-saying-billionaires-pay-8-percent-taxes-not-really/)

[ii] https://www.federalbudgetinpictures.com/do-the-rich-pay-their-fair-share/

Another fascinating article on Econo Week! President Biden, despite his age and occasional memory lapses, has accurately pointed out that the average Joe pays a higher proportion of taxes compared to the top 400 wealthiest income earners. This discrepancy is due to the tax system's exclusion of various forms of income that predominantly benefit the wealthy. The root issue lies in the complexities of the tax code rather than the validity of the statistic. Bottom line: the rich are getting richer--much of it tax free!