Somehow, when I wasn’t paying attention, time passed, and much to my surprise I turned 65 this month. When I was younger, 65 seemed ancient and totally irrelevant, since I couldn’t imagine ever being that old. Yet here I am, still in my “prime” working years, and – aside from an unreasonable fear of stairs and escalators – I feel as young as I ever did. Actually, turning 65 has some incredible benefits. First of all, as a 65-year-old woman I can expect to live another 21 years (although that number declined a bit due to COVID).[i] My mother is 95, so I also have longevity in my genes. My “baby” just turned 21 (yes, I had my children late in life!), so I am now past the challenges of raising a family. But the biggest benefit of all is that I no longer have to fear financial ruin if I have a medical problem.

Medicare is a game-changer. All 65-year-olds are eligible for Medicare – in fact, in some cases there is a penalty if you don’t enroll (I suppose that is to get as many younger/healthier people as possible in the insurance pool). People who transition from an employer-paid plan to Medicare might not notice the benefits quite as much, especially if they have a good plan. But I have been on the so-called “individual market” for the past seven years. It is expensive and even with the Obamacare subsidies, after premiums and deductibles, I had to spend north of $15,000 before coverage kicked in.

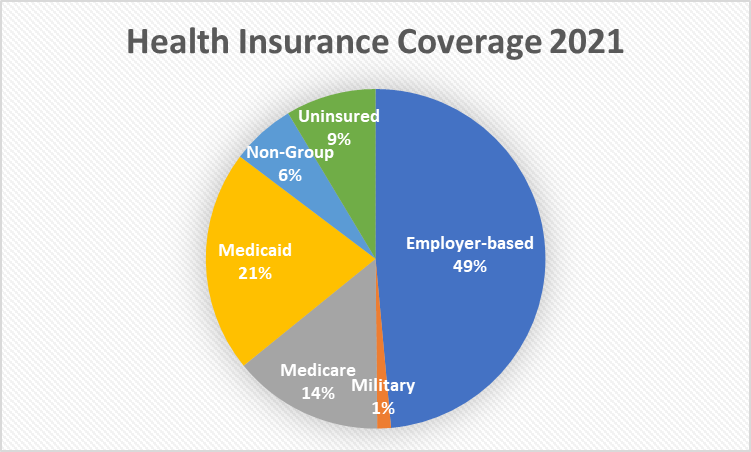

With respect to health insurance, the U.S. population basically breaks down into five different groups. Insured individuals are covered either by employer-sponsored plans, Medicare, Medicaid, or non-group plans such as those offered under Obamacare. Uninsured individuals are, well, uninsured. Fortunately, their numbers have declined substantially in the past few years, but there are still nearly 30 million uninsured individuals.

The following graph shows the breakdown in coverage as of 2021.[ii]

Half of all Americans are covered under employer-based plans (including the military). Employers generally cover from 70% to 85% of premiums,[iii] and deductibles tend to be low.[iv] That means an individual covered by an employer-sponsored plan would typically pay $3,000 to $4,000 annually in total healthcare costs. In reality, employees are actually paying the full amount of the premium, since it is money that would otherwise be available for wages, but they don’t feel it in the form of out-of-pocket costs.

Another third of the U.S. population is covered by either Medicare or Medicaid. People on Medicaid pay very low premiums, but they may struggle to find providers that accept Medicaid. Nearly a third of doctors do not accept new Medicaid patients, twice as many as the doctors who don’t accept Medicare.[v] Medicare premiums are fixed at a low level. Most people will not pay more than $165 per month but there can be gaps in coverage for hospitals and other care. Medicare supplements are offered to cover that gap, or Medicare enrollees can choose a Medicare Advantage plan. These plans often offer dental and vision care (and sometimes even gym memberships), and premiums are paid by the federal government. While these plans may limit care options (i.e., the insurance company gets to decide what medical care you can have), they are no different from other insurance plans in that regard. Most Medicare enrollees pay up to a maximum of $3,500 per year in total out of pocket costs.

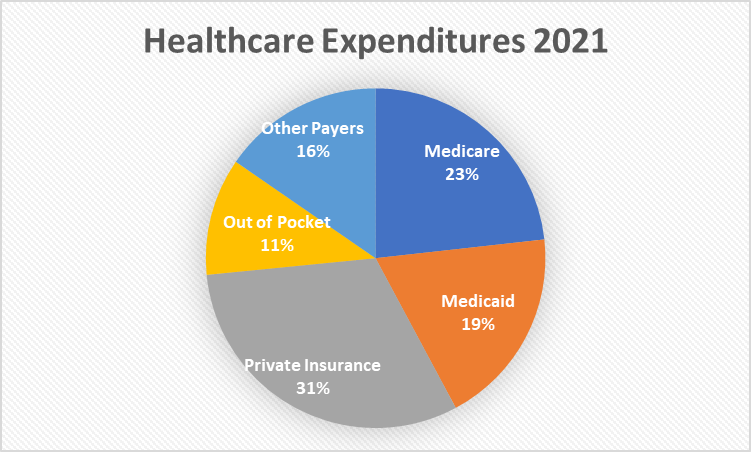

But while only 14% of the U.S. population is covered by Medicare, Medicare spending accounts for nearly a quarter of all healthcare spending. By contrast, Medicaid recipients account for 21% of enrollees, but only 19% of spending. The following chart shows the breakdown of spending by coverage provider.[vi]

Let’s be really clear here: The federal government spends over $900 billion per year on Medicare, with one quarter of that spending in the last year of life.[vii] People who are working and paying taxes are spending $225 billion per year – about $1,350 per worker – to keep old people alive an extra year. Meanwhile, as I detailed in my August 1, 2023 post, rising healthcare costs are one of the impediments keeping Millennials and Zoomers from meeting the same financial milestones as their parents and grandparents.

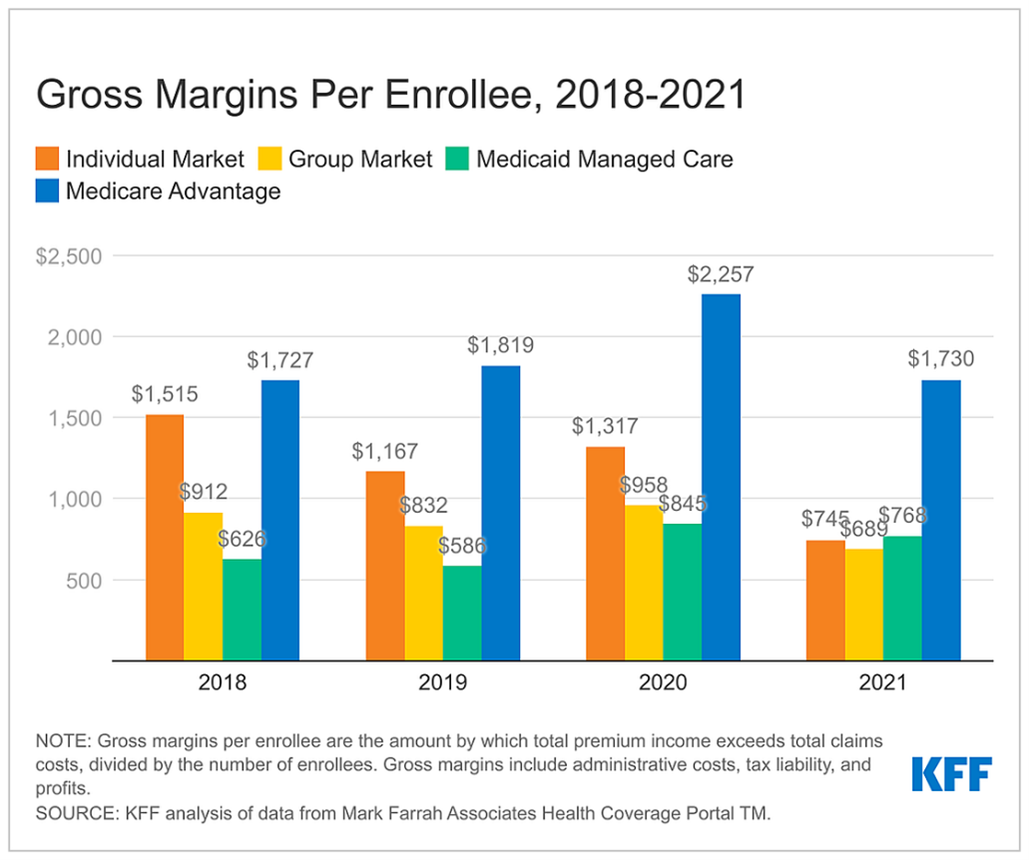

And the rate of spending is growing. While total spending on healthcare grew by 2.7% in 2021, Medicare and Medicaid spending grew 8.4% and 9.2% respectively, while other payers (typically public health spending) fell 20.7%.[viii] Half of all Medicare spending goes to Medicare Advantage, versus traditional Medicare, up from 28% in 2022.[ix] And the Medicare Advantage providers are making a killing. According to the Kaiser Family Foundation,[x] insurance companies made more than $1,730 per Medicare enrollee – more than double what they earn on Medicaid, private insurance and Obamacare (see graph below). United Healthcare, the largest provider of Medicare Advantage plans, saw its profits increase 16% in 2022. And not to put too fine a point on it, the CEO of UnitedHealth Group made $18.4 million in total compensation in 2021, a relative pittance compared with other healthcare CEOs.[xi] Medicare advantage has been called a give-away to the insurance companies, and it is.

I am very grateful to be able to leave the individual market, where I and my family had to think twice before going to the doctor. A few years ago, a visit to the ER for a broken toe cost me over $2,000 – even though there was nothing they could do other than tell me to stay off my feet. The only thing crazier than the cost of health insurance is the cost of health care. But that is a subject for a future post.

For now, let me just thank the Millennials and Zoomers who are funding my low monthly premiums and out of pocket expenses. But I am still working, and I should be funding theirs as well, as should wealthy retirees, and everyone who pays taxes. There is no reason why young people and families with children should be paying taxes so I can have cheap health insurance, while they can’t afford to take their own children to the doctor. There is no reason we can’t expand access to Medicare to everyone. I think a politician even coined a phrase once… he called it “Medicare for all” or something to that effect. Yes, taxes would have to go up, but healthcare costs would go down by more, and on balance people would have more money in their pockets. Politicians make it seem like most people prefer the current system, citing polls saying most people are happy with their current healthcare coverage. They aren’t, but they’ve been convinced by those same politicians that anything run by the government must be bad. But if we expanded Medicare to cover everyone, the giveaway to the insurance companies would have to come to an end, and the federal government would have to negotiate prices for drugs and other healthcare services. In other words, address the crazy cost of healthcare. That would cut into the enormous profits insurance companies currently make on Medicare, so until we have politicians willing to put the interests of their constituents ahead of the insurance industry, nothing will change. Again, thanks Millennials and Zoomers.

[i] https://www.statista.com/statistics/266656/us-female-life-expectancy-at-the-age-of-65-years-since-1960/#:~:text=Life%20Expectancy%20%2D%20Women%20at%20the,in%20the%20U.S.%202000%2D2020&text=The%20life%20expectancy%20for%20women,comparison%20to%20the%20previous%20year.

[ii] https://www.kff.org/other/state-indicator/total-population/?currentTimeframe=0&sortModel=%7B%22colId%22:%22Location%22,%22sort%22:%22asc%22%7D

[iii] https://www.peoplekeep.com/blog/what-percent-of-health-insurance-is-paid-by-employers

[iv] https://www.kff.org/mental-health/report/2022-employer-health-benefits-survey/#:~:text=The%20average%20deductible%20among%20covered,than%20workers%20at%20larger%20firms.

[v] https://www.macpac.gov/wp-content/uploads/2021/06/Physician-Acceptance-of-New-Medicaid-Patients-Findings-from-the-National-Electronic-Health-Records-Survey.pdf

[vi] https://www.cms.gov/research-statistics-data-and-systems/statistics-trends-and-reports/nationalhealthexpenddata/nhe-fact-sheet

[vii] https://www.cms.gov/Research-Statistics-Data-and-Systems/Research/ActuarialStudies/downloads/Last_Year_of_life.pdf

[viii] https://www.cms.gov/research-statistics-data-and-systems/statistics-trends-and-reports/nationalhealthexpenddata/nhe-fact-sheet#:~:text=NHE%20Fact%20Sheet,-Historical%20NHE%2C%202021%3A

[ix] https://www.kff.org/interactive/the-facts-about-medicare-spending/

[x] https://www.kff.org/medicare/press-release/medicare-advantage-insurers-report-much-higher-gross-margins-per-enrollee-than-insurers-in-other-markets/#:~:text=In%202021%2C%20Medicare%20Advantage%20insurers,managed%20care%20market%20(%24768).

[xi] https://www.beckerspayer.com/payer/the-10-highest-paid-ceos-at-publicly-traded-health-insurance-companies.html